File Your Beneficial Ownership Information (BOI) Report on Time

Contractors manage demanding schedules and complex regulations every day. Let the American Contractors Organization handle the BOI reporting process, so you can concentrate on running your business. Our plans, starting at just $125, make staying compliant simple and stress-free.

What is Beneficial Ownership Information Reporting?

Beneficial Ownership Information (BOI) reporting is a requirement under the Corporate Transparency Act, enforced by the Financial Crimes Enforcement Network (FinCEN). Companies must disclose details about individuals who own or control 25% or more of the company or have significant influence over it. This process helps authorities maintain transparency in corporate ownership, which is key to preventing financial crimes like money laundering.

Choose Your BOI Reporting Plan

Standard Plan

Perfect for contractors who do not anticipate making ownership or qualifying changes to their business.-

Collection and organization of your information for the report.

-

Timely email reminders to keep you on track.

-

Allows you to Review and Confirm before Submitting

-

Receive your FinCEN BOIR ID number & FinCEN filing transcript

Why Choose American Contractors Organization for Your BOI Reporting?

Contractors rely on us to handle their Beneficial Ownership Information Reports with accuracy and efficiency. With a deep understanding of the construction industry, we offer a straightforward process that fits seamlessly into your busy schedule.

Simple, Clear Process

We provide straightforward steps and clear guidance, making BOI reporting easy and hassle-free. You’ll know exactly what’s needed, every step of the way.

Built for Contractors

We understand the demands on contractors. Our service is designed to fit your schedule, providing the support you need with minimal disruption to your work.

Peace of Mind

Trust us to handle the details so you don’t have to worry. With our expertise and thorough approach, you can rest easy knowing your BOI report is in good hands, filed accurately and on time.

Our Commitment to Your Success

Beyond just filing your BOI report, our priority is ensuring your business remains compliant and stress-free. Here’s what sets our service apart:

Dedicated Support Team

Our team is always ready to assist you with any questions or concerns, ensuring you never feel lost during the process.

Transparent Communication

We keep you informed every step of the way, from gathering your information to submitting the final report.

Long-Term Compliance Focus

We don’t just help you file your report—we also provide tips and resources to help you stay compliant year-round, avoiding potential pitfalls in the future.

Why Get Help with Your BOI Report?

Filing your Beneficial Ownership Information Report correctly and on time is critical to avoid severe consequences. Here’s why it’s essential to get expert assistance:

Avoid Costly Civil Penalties

Inaccurate or late filings can result in civil fines of up to $591 for each day the violation continues. Don’t let small mistakes add up to big financial consequences.

Prevent Criminal Charges

Willful violations of BOI requirements can lead to criminal penalties, including up to two years of imprisonment and fines up to $10,000.

Safeguard Your Business

Don’t leave your compliance to chance. Properly filing your BOI report is crucial to maintaining your business’s good standing and avoiding disruptions.

What is the Corporate Transparency Act

Effective January 1, 2024, the Corporate Transparency Act was established to increase transparency in U.S. business ownership. This law aims to prevent financial crimes, such as money laundering and fraud, by requiring businesses to report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

Key Points:

- Preventing Financial Crimes: The Act targets financial crimes by ensuring those behind significant business decisions are known and traceable.

- Enhancing Transparency: By disclosing beneficial ownership, companies contribute to a more transparent market, fostering trust and accountability.

- Legal Compliance: Companies must comply with this Act to avoid severe penalties, including fines and possible imprisonment for non-compliance.

Who Needs to Comply?

The Corporate Transparency Act requires most U.S.-registered entities to report their beneficial owners to FinCEN. This includes corporations, LLCs, LPs, LLPs, and certain trusts. Exemptions apply to publicly traded companies, banks, and large operating companies with more than 20 employees, $5 million in gross receipts, and a physical U.S. presence. If your business doesn’t meet these exemptions, compliance is mandatory to avoid legal and financial penalties.

Who is a Beneficial Owner?

A beneficial owner is an individual who:

- Owns 25% or more of a company’s equity.

- Exercises significant control over the company’s operations, including decision-making roles like executives or senior managers.

- Has substantial influence over major decisions, even if they don’t hold a formal title.

What are the Penalties for Not Filing the BOI Report?

Failing to comply with the Corporate Transparency Act can lead to serious consequences for your business. The penalties for not filing a Beneficial Ownership Information (BOI) Report are severe and can significantly impact your operations.

According to the Act, any person who willfully fails to meet the BOI reporting requirements may face:

- Civil Penalties: Up to $591 per day for each day the violation continues. This amount is adjusted annually for inflation.

- Criminal Penalties: Up to two years in prison and a fine of up to $10,000 for willfully failing to file, submitting false information, or neglecting to update previously reported information.

For businesses registered before January 1, 2024, there is a grace period until January 1, 2025, to file their reports. New businesses, or those established after January 1, 2024, must submit their documentation within 90 days of registration. It’s essential to ensure that all submitted information is accurate and complete to avoid additional penalties.

Complying with the Corporate Transparency Act can be challenging, especially without expert guidance. The American Contractors Organization offers comprehensive support to help your business navigate these requirements, ensuring your report is filed accurately and on time, so you can avoid these significant penalties.

Frequently Asked Questions

The BOI Report is a mandatory filing under the Corporate Transparency Act, requiring companies to disclose information about individuals who own or control the company.

All domestic and foreign reporting companies are required to file a Beneficial Ownership Information (BOI) report unless they qualify for an exemption. Domestic reporting companies include corporations, limited liability companies (LLCs), or any other entity created by filing a document with a secretary of state or similar office in the United States. Foreign reporting companies include entities formed under the laws of a foreign country that have registered to do business in the United States by filing a document with a secretary of state or similar office.

However, there are 23 specific types of entities that are exempt from filing BOI reports. These exemptions include publicly traded companies, certain large operating companies, tax-exempt entities, banks, credit unions, insurance companies, and other entities outlined in the FinCEN guidelines. If you’re unsure whether your company qualifies for an exemption, you can contact us for expert guidance to ensure compliance with BOI reporting requirements.

To complete a Beneficial Ownership Information (BOI) report, you’ll need to provide several key details. These include the company’s legal name and any registered business names, as well as the company’s EIN (Tax Identification Number). You’ll also need to include the date of business formation and provide full names and dates of birth for all beneficial owners. Additionally, identification for each owner is required, which can include a U.S. passport, state-issued driver’s license, U.S. government ID, or foreign passport. If available, the FinCEN ID for each business owner should also be included. Ensuring this information is accurate and complete is crucial for a successful report submission.

Businesses registered before January 1, 2024, must file by January 1, 2025. Companies registered after January 1, 2024, have 90 days from their registration date.

Failing to file can result in civil penalties of up to $591 per day and criminal penalties, including fines up to $10,000 and imprisonment.

A beneficial owner is anyone who owns 25% or more of a company or exercises significant control over its operations.

Yes, if there are changes to your business, such as ownership, management, or any other key details, you are required to update your BOI Report within 30 days. With our Plus Plan, you can easily manage these updates and stay compliant without the stress.

There are 23 specific types of entities that are exempt from filing BOI reports. These exemptions include publicly traded companies, certain large operating companies, tax-exempt entities, banks, credit unions, insurance companies, and other entities outlined in the FinCEN guidelines. If you’re unsure whether your company qualifies for an exemption, you can contact us for expert guidance to ensure compliance with BOI reporting requirements.

You only need to file the Beneficial Ownership Information (BOI) report once, but you are required to update it within 30 days of any changes to your business’s ownership structure or other key information. This ensures that the information remains accurate and compliant with FinCEN regulations. Our Plus Plan is designed to assist you with these updates, providing support whenever changes occur throughout the year, so you can stay compliant without the hassle

Yes, if more than one individual meets the criteria, all must be reported as beneficial owners.

The Act aims to increase transparency in business ownership to combat financial crimes like money laundering and fraud.

Filing the BOI Report is a legal requirement, and failure to comply can result in severe penalties, affecting your business’s operations and reputation.

American Contractors Organization offers comprehensive support to ensure your report is filed accurately and on time.

Navigating the BOI reporting process can be complex. Our team at American Contractors Organization will handle the submission for you, ensuring that everything is completed accurately and in full compliance with FinCEN’s requirements.

Yes, 23 types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

The following table summarizes the 23 exemptions:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

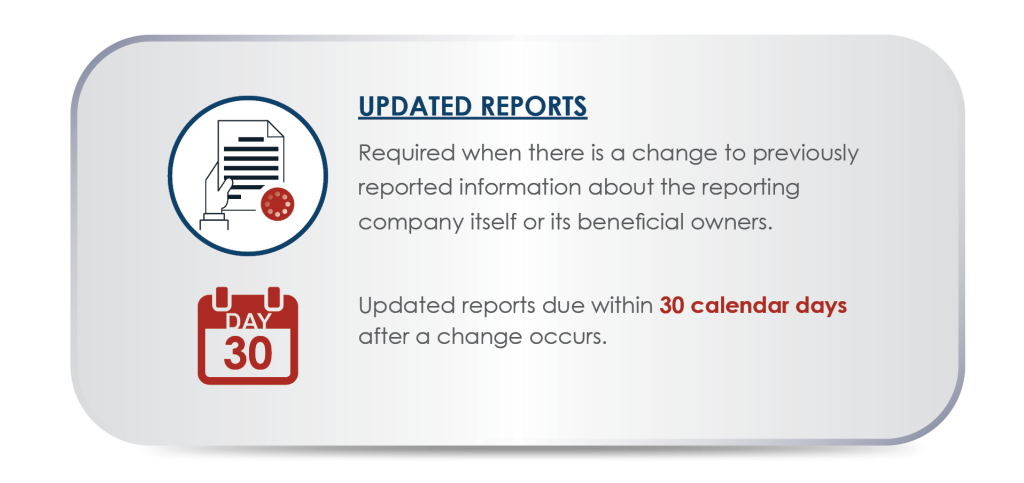

If there is any change to the required information about your company or its beneficial owners in a beneficial ownership information report that your company filed, your company must file an updated report no later than 30 days after the date of the change.

A reporting company is not required to file an updated report for any changes to previously reported information about a company applicant.

The following infographic sets out updated reports timelines.

Chapter 6.1, “What should I do if previously reported information changes?” of FinCEN’s Small Entity Compliance Guide provides additional information.

No. A change to the type of ownership interest a beneficial owner has in a reporting company—for example, a conversion of preferred shares to common stock—does not require the reporting company to file an updated BOI report because FinCEN does not require companies to report the type of interest. Updated BOI reports are required when information reported to FinCEN about the reporting company or its beneficial owners changes.

FinCEN’s Small Entity Compliance Guide includes additional information on when and how reporting companies must update information in Chapter 6, “What if there are changes to or inaccuracies in reported information?”

Updated BOI reports will require all fields to be submitted, including the updated pieces of information. For example, if a reporting company changes its legal name, the reporting company will need to file an updated BOI report to include the new legal name and the previously reported, unchanged information about the company, its beneficial owners, and, if required, its company applicants.

A reporting company that filed its prior BOI report using the fillable PDF version may update its saved copy and resubmit to FinCEN. If a reporting company used FinCEN’s web-based application to submit the previous BOI report, it will need to submit a new report in its entirety by either accessing FinCEN’s web-based application to complete and file the BOI report, or by using the PDF option to complete the BOI report and upload to the BOI e-Filing application.

Yes, once we submit your BOI filing to FinCEN, you will receive a FinCEN transcript. This serves as confirmation that your filing is with FinCEN, meaning you are compliant.